CLEARING

Clearing is defined under EMIR (European Market Infrastructure Regulation) as the process of establishing positions, including the calculation of net obligations, and ensuring that financial instruments, cash, or both are available to secure the exposures arising from these positions.[1] For futures and options clearing, it refers to the process of daily marking-to-market, netting and daily settlement of positions leading to the establishment of final delivery positions in cash, commodities or securities.

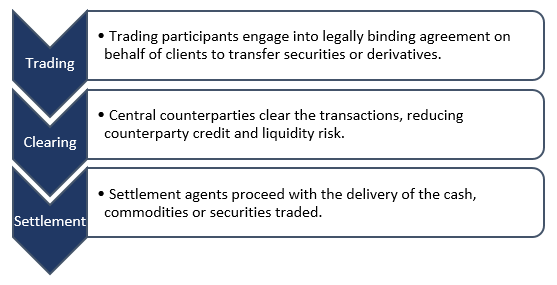

Within the trading value chain, clearing occurs after trading and before the settlement of trades, as part of the post-trade processing (Please see Figure 1). Traditionally, the clearing phase was executed bilaterally between buy-side and the sell-side firms. In a derivatives transaction, the parties would agree to an exchange of the underlying securities for cash on a specific date. The period of time between trading and settlement during the life of the derivatives contract would expose the two parties to counterparty credit and liquidity risks. In order to limit the impact of those risks, special purpose entities called Central Counterparties (CCPs) were created to legally interpose themselves in the transaction, acting as an intermediary between buyers and sellers of financial instruments, becoming the buyer to every seller and the seller to every buyer.

CCPs were historically present in derivatives and repo markets, where the period of time between trading and settlement is longer. However, their importance in the OTC derivatives markets was marginal prior to 2008. As the Global Financial Crisis (GFC) exposed opaque webs of bilateral derivatives, often poorly or not collateralised at all, the G20 leaders committed to set regulatory initiatives to promote central clearing in 2009, including the central clearing mandate for forward rate agreements (FRAs), interest rate swaps (IRS) and Credit Default Swaps (CDS); and the higher capital and margin requirements for uncleared contracts. As a consequence of the efforts to promote financial stability, central clearing in the OTC derivatives ecosystem has gained significant momentum within the last decade, leading to 78% of interest rate derivatives and 62% of CDS being centrally cleared as of 2021.[2]